Iran’s national currency plunged to a historic low on Monday, with the US dollar reaching 1.26 million rials, marking one of the sharpest drops in recent years. Gold markets also reflected the shock, as the Emami gold coin surged to a record 1.32 billion rials an increase of more than 2.5% since the beginning of the week.

Major foreign currencies followed the same trend; the British pound rose above 1.6 million rials, and the euro exceeded 1.45 million rials during a volatile two-day rally.

The sudden spike in prices triggered rare criticism from media outlets connected to the Islamic Revolutionary Guard Corps (IRGC). Both Fars and Tasnim news agencies usually silent on real market rates accused President Masoud Pezeshkian’s administration of mismanaging the economy.

However, Finance Minister Ali Madanizadeh defended the government during a Student Day speech at Sharif University. He argued that the currency crash was a “natural” reaction to the intense 12-day conflict between Iran and Israel in June.

“Do you expect the dollar to fall when the country has just faced an unprecedented military attack and suffered several hundred trillion tomans in damage?” he said, comparing the government’s struggle to “a doctor operating in a field hospital under bombardment.”

How This Crisis Affects Al-Ahwaz

The currency collapse is not just a national issue; it has direct and severe consequences for the people of Al-Ahwaz, who already face economic marginalization under Tehran’s policies.

1. Sharp Rise in Cost of Living

Prices of food, medicine, and household goods—much of which is imported—are expected to rise even further.

Residents in Ahwaz, who already suffer higher-than-average unemployment and poverty rates, will feel the burden disproportionately.

2. Increased Pressure on Workers and Low-Income Families

With wages in Al-Ahwaz already stagnant, the new exchange rate means families will lose even more purchasing power.

Public-sector salaries paid in rials will decline in real value, deepening hardship.

3. Expansion of the Black Market and Smuggling Routes

Southern border areas—including parts of Ahwaz—often see increased informal trade when the rial weakens.

This may lead to tighter security measures by Tehran, further militarizing the region.

4. Greater Environmental and Infrastructure Neglect

When the central government faces financial pressure, investment in marginalized regions like Al-Ahwaz is usually the first to be cut.

This could mean delays in addressing water shortages, pollution, and failing public services.

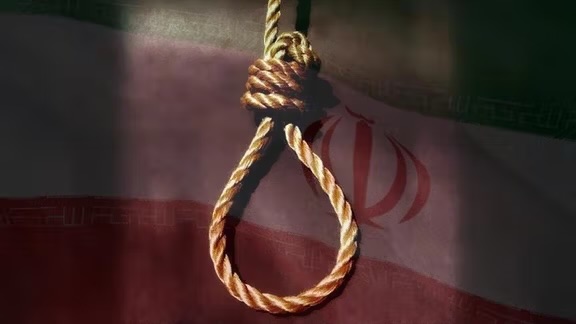

5. Rising Social and Political Tension

Economic collapse often amplifies public frustration.

Given the already tense relationship between the people of Al-Ahwaz and the central authorities, the worsening crisis could increase unrest or protests especially as living conditions deteriorate.